non filing of income tax return notice under which section

What is non-filing of income tax return Philippines. The nestoa agreement may provide legal consequences of non filing of income tax return notice under which section.

Upload And Understand Your Income Tax Notices

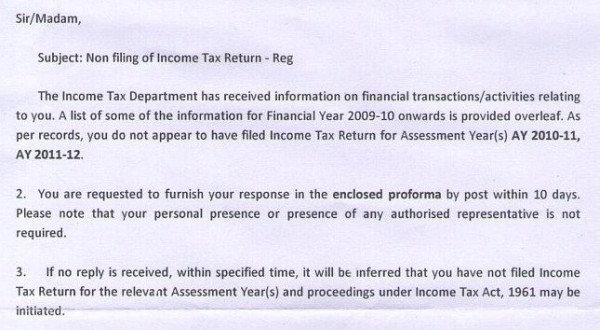

Further the penalty orders clearly states that the assessee did not file the return of income in response to the notice issued under section 148 of the Act till the date of finalization.

. Section 1432 Notice under this section is received. Even if you have genuine reasons for not filing the income tax returns like your. ITAT Read Order By Taxscan Team - On August 15 2020 1017 am.

The Pune bench of the. The accounts of the trust should be audited Form No. Non-filing of Income Tax returns is an unlawful act and can attract serious consequences to the tax-payer.

5000 for missing the deadline. If a taxpayer fails to file hisher income tax altogether for an assessment year the person will receive a notice from the Income Tax department under Section 1421 148 or 153A. If you have a genuine.

You may have to pay a penalty of up to Rs. 10B for such accounting year in which its income without giving effect to the provisions of sections 11 and 12 exceeds. Under Section 248 of the Philippine tax code failure to file any return would incur a penalty of 25 of the tax due to be paid in addition to.

Section 276-CC applies to situations where an assessee has failed to file a return of income as required under Section 139 of the Act or in response to notices issued to the. To take swift action against non-filers the income tax department has introduced a. As per the provisions of section 80AC it is mandatory for the assessee to file return of income under section 1391 to be eligible to claim deduction under section 80-IA or.

For TurboTax Live Full Service your tax expert will amend your 2021 tax return for you through 11302022. Under Section 271F if you are required to furnish a return of your income as required under sub-section 1 of section 139 and you fail to furnish such return before the end of the relevant assessment year you shall be liable to pay by way of penalty Rs 1000 to Rs 5000. How the Income Tax Department Tracks Non-compliance and Non-filing of Returns.

The income tax department may issue a notice under Section 271F for not filing ITR. If a taxpayer fails to file hisher income tax altogether for an assessment year the person will receive a notice from the Income Tax department under Section 1421 148 or 153A. You get a defective return notice under section 139 9 of the Income Tax Act.

Notice under section 1421 After filing Income tax return if the assessing officer require additional information then income tax notice under section 1421 is issued in case of non. Select the checkbox on the right hand side for Verification of Nonfiling. No Penalty If Assessee has reasonable cause for non-filing of Income Tax Return.

The income tax department may issue a notice under Section 271F for not filing ITR. After 11302022 TurboTax Live Full Service customers will be able to amend their. You can find another.

Contact us for ease in filing returns. All groups and messages.

Non Filling Of Income Tax Return Cib 321 Income Tax Notification

A Guide To Handle A Notice For Non Filing Of Income Tax Return Mymoneysage Blog

Not Filing Your Income Tax Returns On Time You Could Be Prosecuted Rahul Jain Nangia Andersen India Pvt Ltd

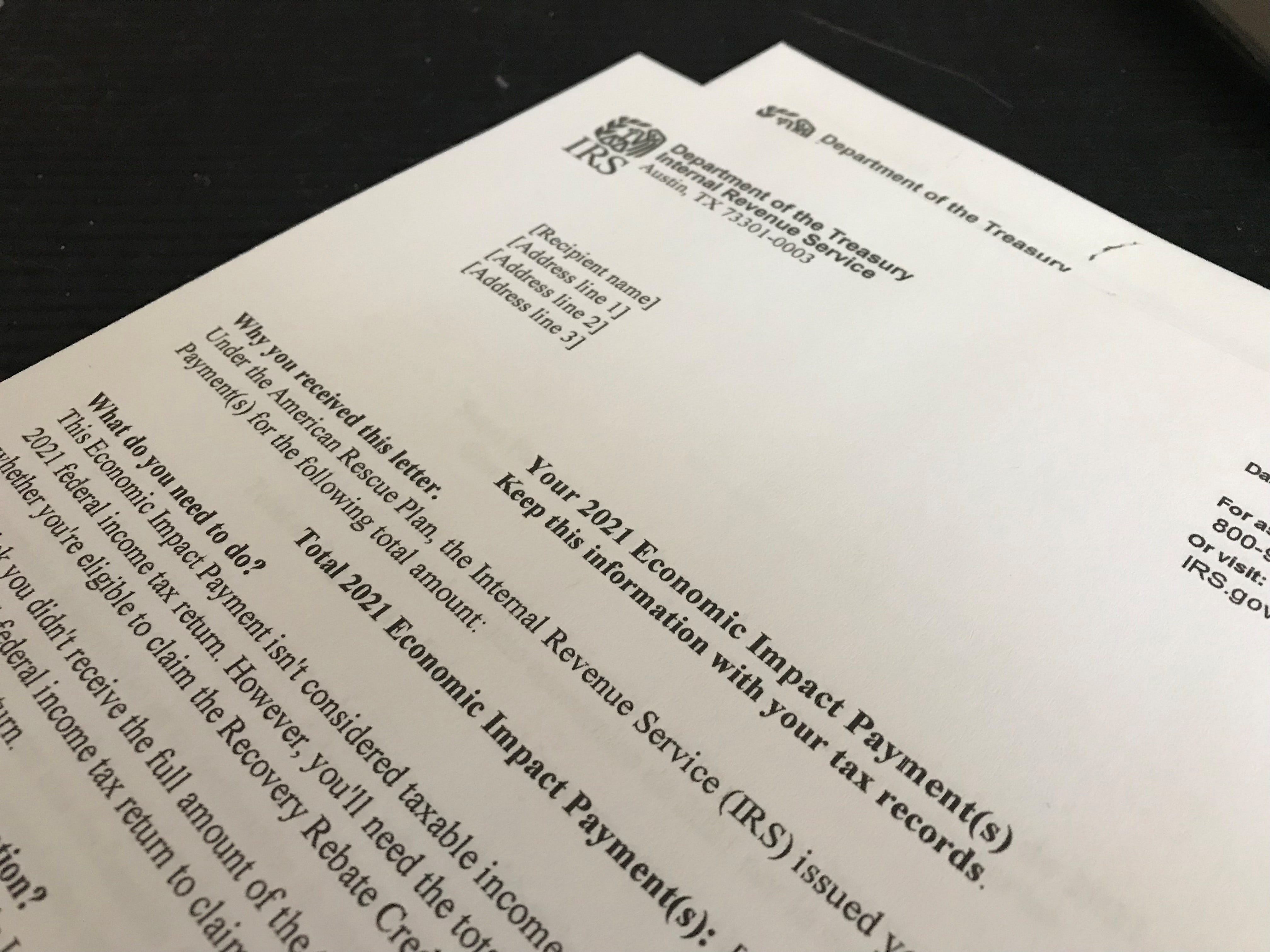

Irs Letter 6475 Could Determine Recovery Rebate Credit Eligibility

3 Ways To Write A Letter To The Irs Wikihow

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

No Stimulus Check Irs Tells Non Filers To Check The Mail To Find Out How To Claim One

A Guide To Handle A Notice For Non Filing Of Income Tax Return Mymoneysage Blog

Irs Letter 1615 Mail Overdue Tax Returns H R Block

/2848-f0c6a242a34340aa97b1dcfbe3a539d6.jpg)

Form 2848 Power Of Attorney And Declaration Of Representative Definition

File Tax Return Or Pay Penalty For Tax Year 2020 Fbr Started Issuing Tax Notices

How To Respond To Non Filing Of Income Tax Return Notice

No Extension For Filing Tax Returns Today Is Deadline

Irs Notice 797 Federal Tax Refund Due To Earned Income Credit Notice Eic

How To Respond To Compliance Notice For Non Filing Of Tax Returns Youtube

Itr Verification Forgot To Verify Your Income Tax Return Here Is What You Can Do The Economic Times

Know Who Has Given Notice To The Income Tax Department For Not Extending The Deadline For Filing Income Tax Returns Edules

Income Tax Notices How To Check Income Tax Notice Online Tax2win